The debt snowball calculator template or formula is a methodology used to gradually reduce the amount of debt one needs to pay, whereby one who owes no more than one record takes care of the records beginning with the smallest of the amounts first, while paying the base installment on bigger debts. When the littlest debt is paid off, one continues to the following bigger debt, thus continuing to the biggest one’s last. Therefore, in other words, the debt snowball method includes taking care of the minor debts first to move them prior to proceeding onward to the greater ones. The debt snowball formula is regularly applied to reimbursing revolving balance, especially like credit cards. Under the method, additional money is put aside to pay debts with the littlest sum owed.

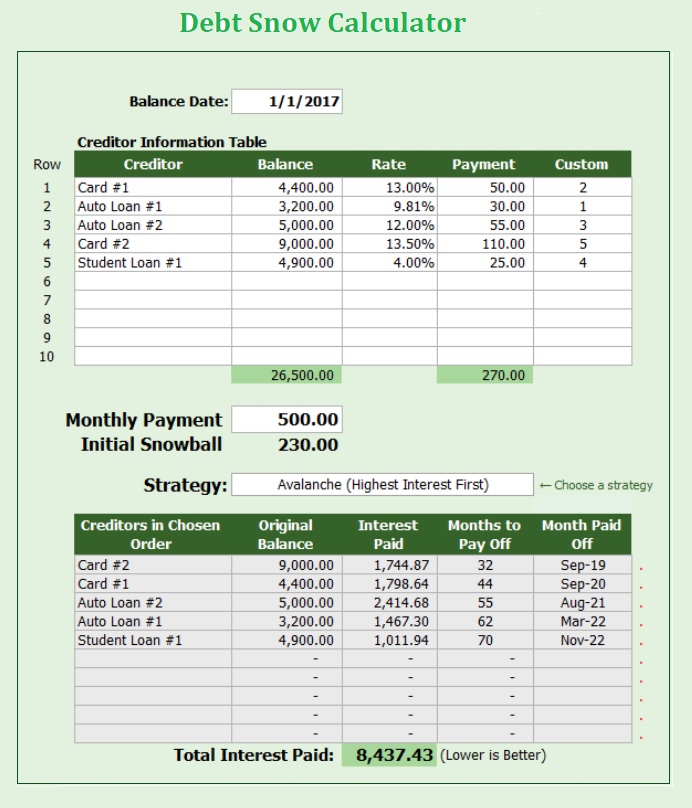

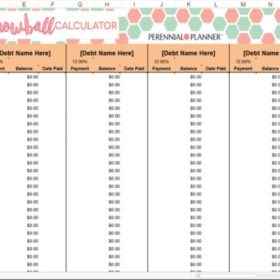

Details of Debt Snow Calculator

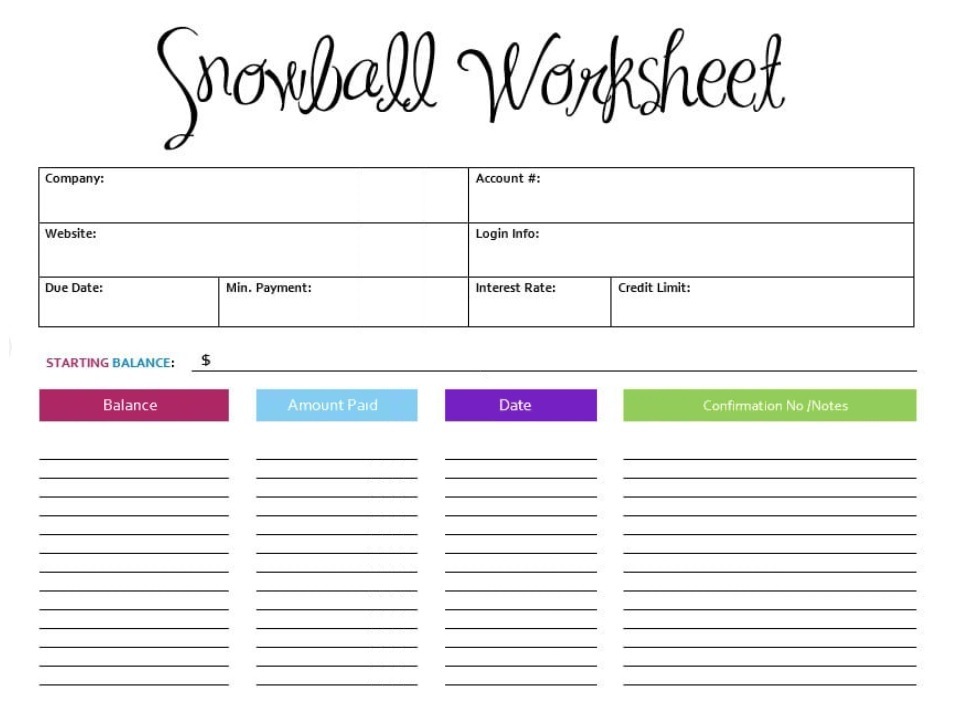

A debt snowball calculator helps you in identifying opportunities where you can save your extra amount by paying the right debt first. Everyone wishes to get out of debt as early as possible, but it is not a simple task to do. However, by adopting good techniques and a plan will firmly help you to make it possible. You make a rundown of the multitude of remarkable sums you owe, in chronological order according to the amount needed to be paid. You prioritize and focus on the most important and easiest first, putting however much additional cash into every installment that you can manage. The others you pay simply the base on. At the point when the primary debt is settled, at that point you focus on the following minor one for the extra-installment treatment.

Application of Debt Snowball Calculator

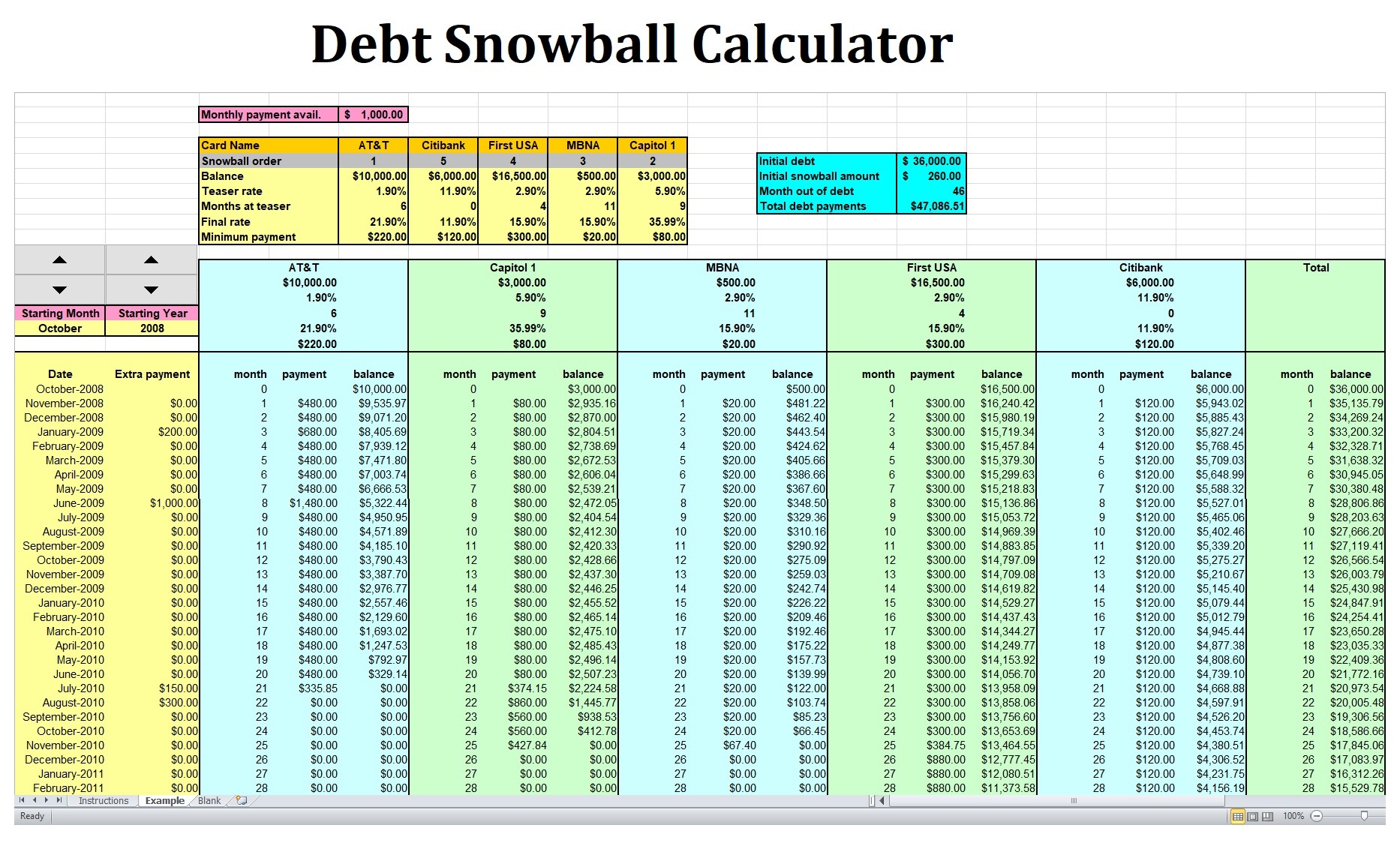

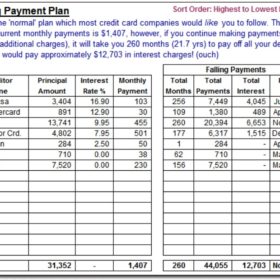

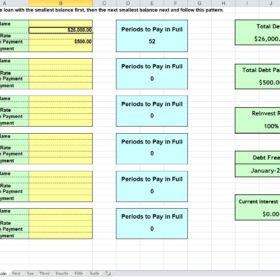

A debt snowball calculator or formula uses the debt roll-up technique, where a payment schedule is prepared to assist the user how easily he/she can pay off his/her debts. The essential strides in the debt snowball method are as per the following:

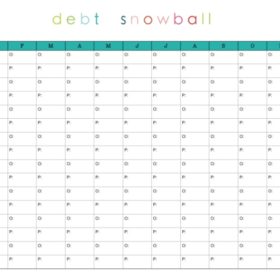

1. Try to make a list of all outstanding debts in rising request, from the easiest one to the heaviest amount in terms of mark-up. This is the most particular element of this method, where the request is dictated by the loan amount, not by the mark-up rate which actually charged. Nonetheless, in the event that two debts are exceptionally close in terms of mark-up, the debt with the higher mark-up rate would be moved above in the rundown.

2. A true commitment required to pay the base installment on each debt.

3. Determine your capacity to pay extra mark-up amount which you can afford towards the smallest loan.

4. Continue paying the base installment amount in addition to the additional mark-up amount towards that minimum debt until it is fully paid off.

5. When a loan is fully settled, add the old least installment from the main debt to the base installment on the second-smallest loan, and apply the new aggregate to reimbursing the second-biggest debt.

6. Repeat this process continuously until all loans are paid off successfully.

In principle, when the last debts are reached, the additional sum paid toward the bigger debts will develop rapidly, like a snowball moving downhill assembling more snow, thus the name.

Efficacy of Debt Snowball Calculator

Using the debt snowball formula can be a powerful method for settling pretty much any sort of debt, except for contract advances. A ton of its allure is mental. It has the debtor target little adjusts to take care of first; eradicating these simpler extraordinary debts gives a persuasive lift, urging the debtor to remain trained and keep on with their debt reimbursements; the manner in which the speedy loss of a couple of pounds urges a health a person following a strict healthy diet to remain with a get-healthy plan. Besides, it fabricates inspiration by settling debts quick and is not difficult to execute, though, it can take more time to turn out to be totally sans debt with utilizing this method.