A credit card payoff calculator template is a basic calculator made specifically to calculate the amount of debt that is due on a credit card and how to pay it off, either in installments or lump sum, within your set amount of earnings. There are a few different ways that you could utilize the outcomes to advise your methodology. Therefore, you take care of your equilibrium quicker and pay less in interest in general. A credit card payoff calculator is provided for customers to facilitate them in calculating the interest amount by themselves, in case, if there is any doubt in their mind. Similarly, it is also available online to calculate installment amount while going for shopping.

Why use a credit card payoff calculator?

Utilizing a credit card for your spending can have numerous advantages, from added legitimate assurance to gathering loyalty points at your number one retailer or cash back. Be that as it may, credit card debt can rapidly mount up on the off chance that you don’t take care of your card in full every month. Contingent upon your circumstance, you may have a few unique choices to take care of your credit card debt. In case, you are not intending to unite your credit card adjustable, there are two methodologies you can utilize: the debt snowball method and the debt avalanche method.

Payoff Methodologies:

The debt snowball method includes simply making the base installments on the entirety of your credit cards, aside from the one with the least credit. Take any additional cash you need to put toward your debt consistently, and apply it to that card. The debt avalanche method works also, yet as opposed to focusing on cards dependent on their equilibrium, you’ll work on taking care of the cards with the most noteworthy interest rates first.

Advantages of using Credit Card Payoff Calculator:

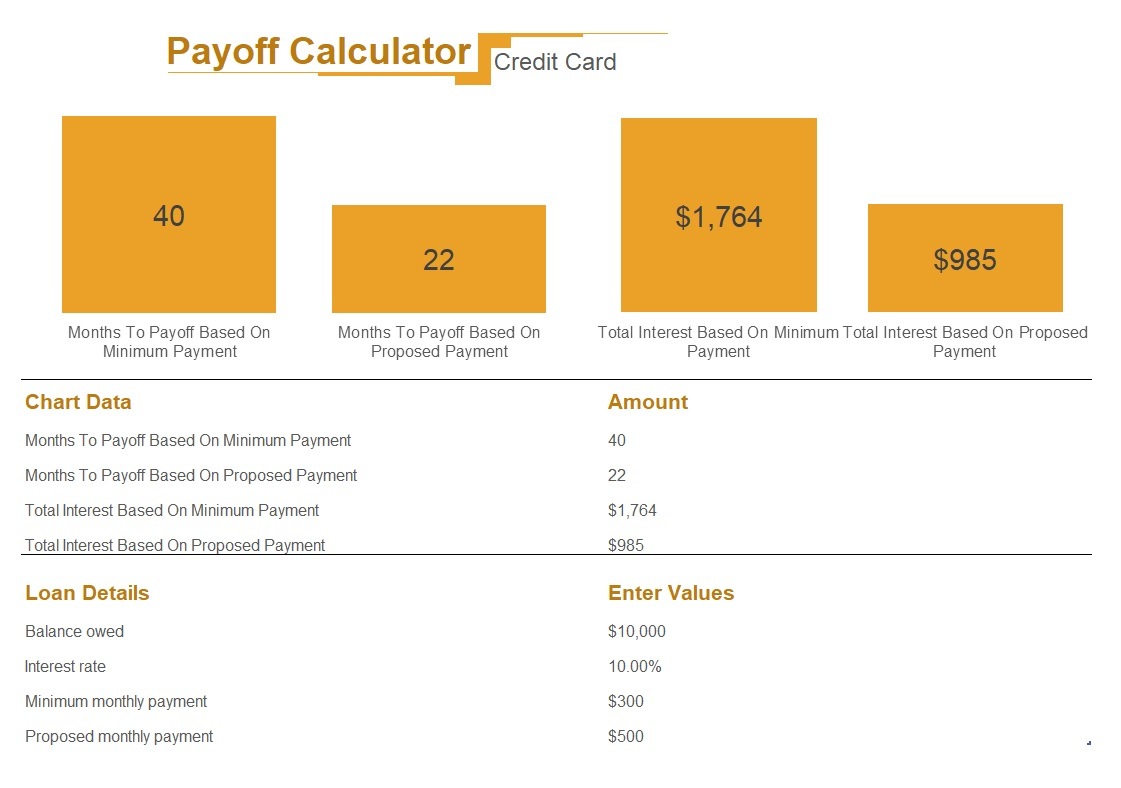

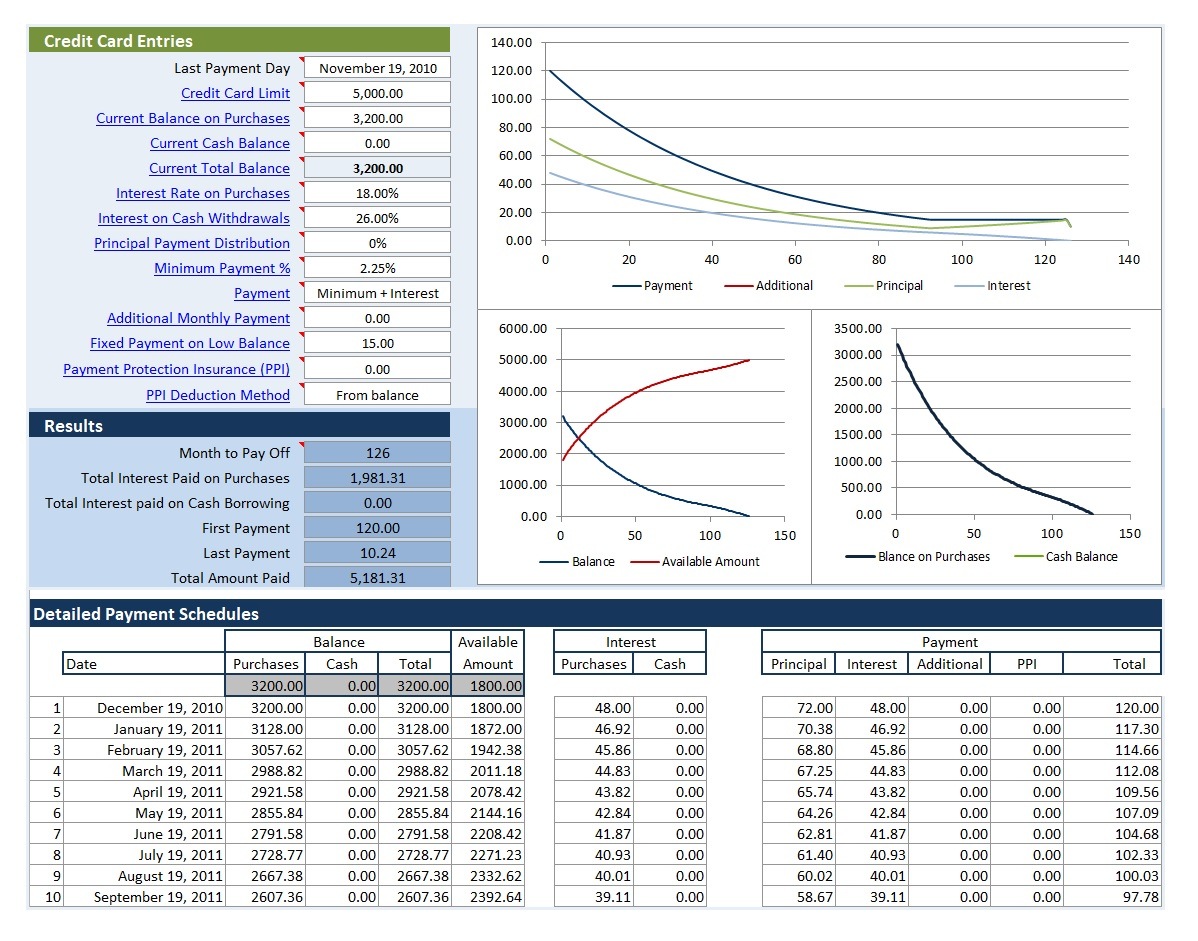

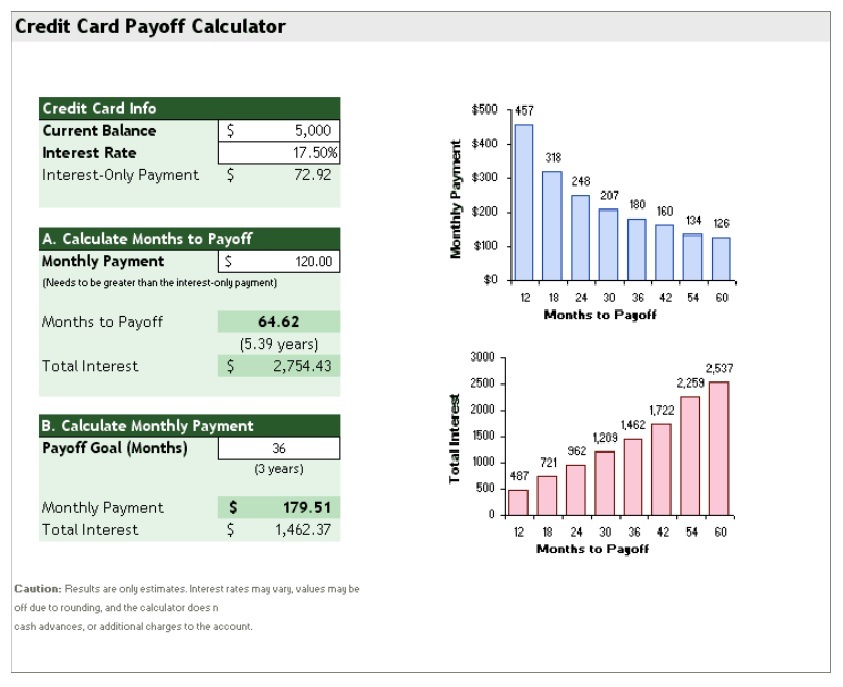

Taking care of credit card debt can help you get a good deal on interest and improve your general monetary prosperity. Regardless of whether you have only one credit card or many, a credit card payoff calculator assists with sorting out what amount of time it will require to take care of your debt and how much interest it will set you back. On the off chance that you have different credit cards, advances or different debts, it’s critical to take a gander at a couple of components when concluding which to take care of first. To set aside the most cash over the long haul, pay down the debt with the most elevated interest rate, or pay the debt that is nearest to your credit max. Moreover, a credit card payoff calculator can help you pick a debt payoff system just like the month and year you’ll be without debt, the quantity of installments you should make and the complete interest you will pay.

How to use credit card payoff calculator?

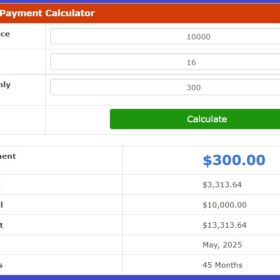

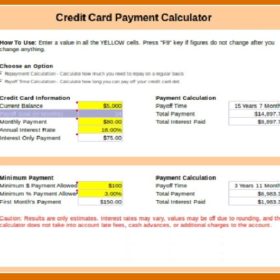

There are various types of credit card payoff calculators accessible online, yet a large portion of them have a couple of essential capacities that are regular in every one of them. For each credit card you have, enter the current balance, the annual percentage rate and your regularly scheduled installment. At the point when you enter the balance and annual percentage rate, the expected least installment will consequently appear in the third field. However, you can transform it dependent on your real installment sum. You can add numerous credit cards to the calculator. Also, as you characterize your technique for dispensing with credit card debt, you can enter a distinctive installment that adds up to perceive how long and cash you’ll save. Enter the record name and equilibrium for your different debts. You can utilize this for just credit card debt, or add different debts like understudy loans and doctor’s visit expenses for a total picture. Put in interest rates and the least regularly scheduled installments. You can discover your credit card interest rates and least installments on your statements.