A cost of goods sold statement template alludes to the immediate costs of creating the goods sold by any company. This sum incorporates the cost of the materials and work used to produce the products. It prohibits circuitous costs, for example, conveyance costs and deals-to-power costs. The cost of goods sold statement is a significant measurement on the fiscal summaries, as it is deducted from an organization’s income to decide its gross profit. Moreover, costs brought about on the goods that were not sold during the year won’t be incorporated when figuring cost of goods sold (COGS), regardless of whether the costs are immediate or aberrant. This statement is not one of the main parts of business reporting as well as financial statements, besides it is rarely prepared and presented in meetings. Whenever it is asked by management to include it in the annual statement, it is usually added to the disclosures segment.

What is a Cost of Goods Sold Statement?

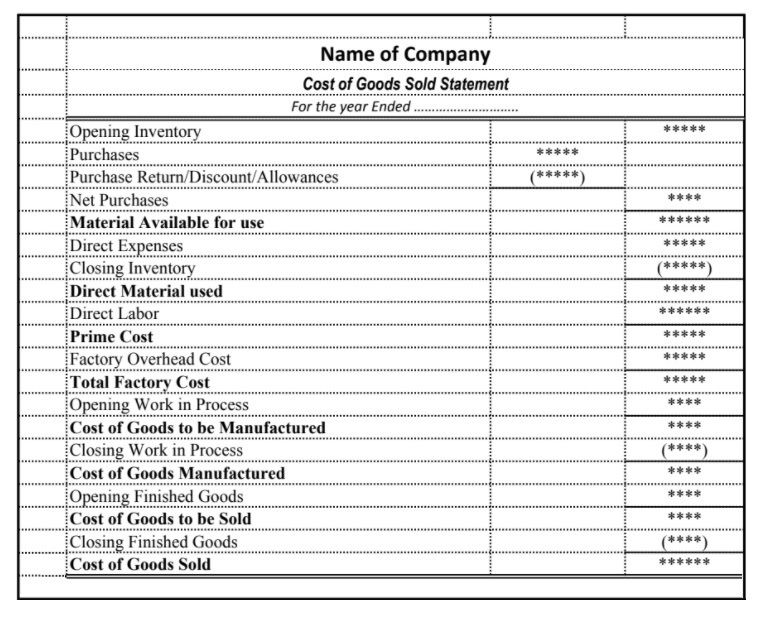

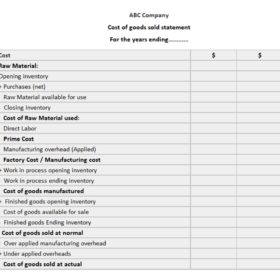

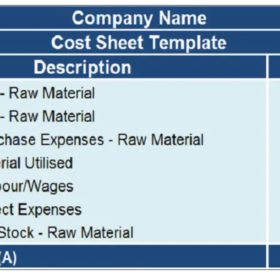

At the end of the day, a cost of goods sold statement incorporates the immediate cost either of manufacturing goods or administration that were bought by clients during the year. To sum up, the cost of goods sold (COGS) is the cost of procuring or assembling the items that an organization sells during a period, so the solitary costs remembered for the action are those that are directly attached to the creation of the items, including the cost of work, materials, and assembling overhead.

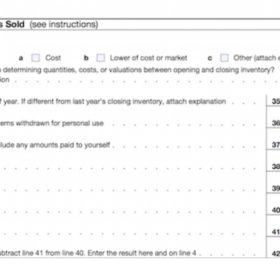

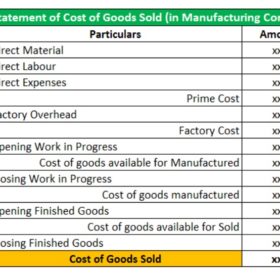

Method to calculate the Cost of Goods Sold Statement:

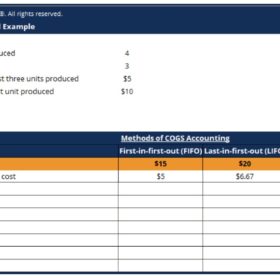

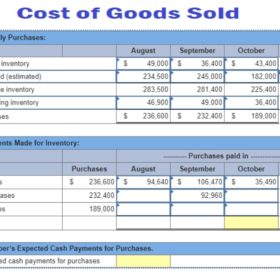

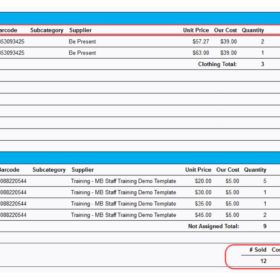

The cost of goods sold statement is determined by including the different direct costs needed to produce an organization’s income. Significantly, this statement depends just on the costs that are directly used in delivering that income. For example, the organization’s stock or work costs can be credited to explicit deals. On the other hand, fixed costs like administrative compensation, leases, and utilities are excluded from the cost of goods sold. Moreover, the stock is an especially significant segment of COGS, and bookkeeping rules license a few unique methodologies for how to remember them for the estimation.

Formula Used to Calculate Cost of Goods Sold Statement:

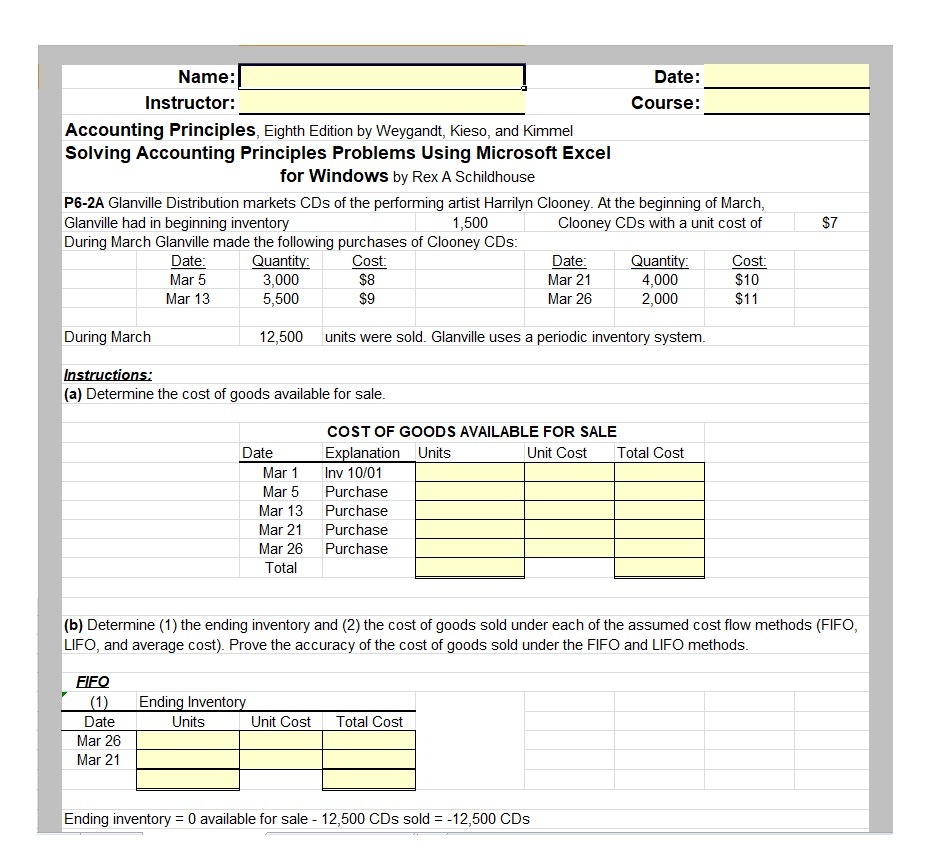

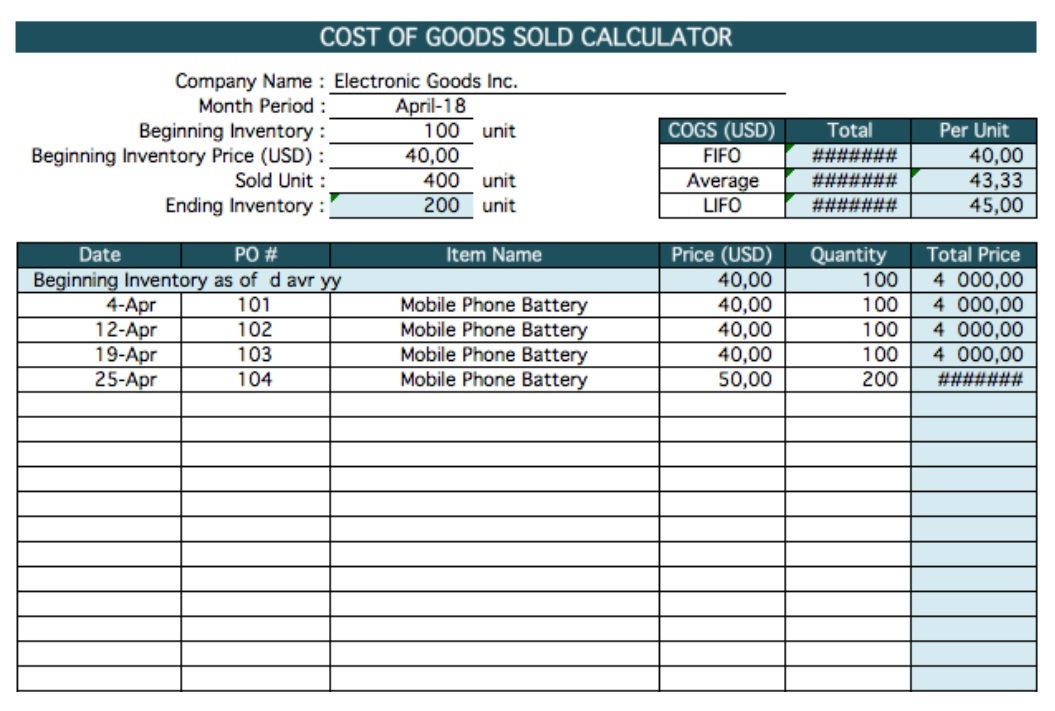

To discover the cost of goods sold during a financial analysis, the following formula is generally used universally, and it is given below:

COGS = Beginning Inventory + Purchases During the Period – Ending InventoryYour starting stock is whatever stock is left over from the past period. At that point, add the cost of what you bought during the period. Deduct whatever stock you don’t sell toward the finish of the period.

Advantages of Using Cost of Goods Sold Statement:

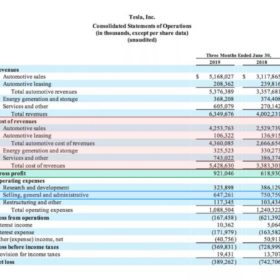

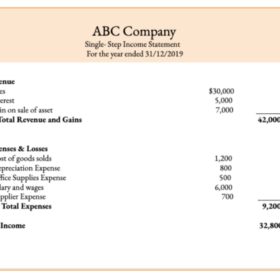

As we know, it is a component of the annual statement or report of any corporate company. It plays a very crucial role not only in calculating primary costs, but also in attracting new investors. Moreover, this statement is a key factor in financial statements, and is used to find out the real profitability of any organization during a specific period. The financial analyst loves to see this statement to calculate before and after-tax earnings. An organization needs to keep the faultless cost of goods sold in an account system if they wish to take advantage of their annual tax return. It will assist management in calculating exact manufacturing as well as inventory expenses, which are further used in many statements. Most tax consultants use this format while assisting organizations in lowering their taxable income. Furthermore, this statement is very crucial while calculating taxable income, and it gives accurate insight into the financial health of any organization. Many financial analysts use it to determine true net income during the calendar year along with gross profit margin. While the gross profit margin can be sorted out by deducting revenue from the cost of goods sold.